Click here to download the Executive Summary.

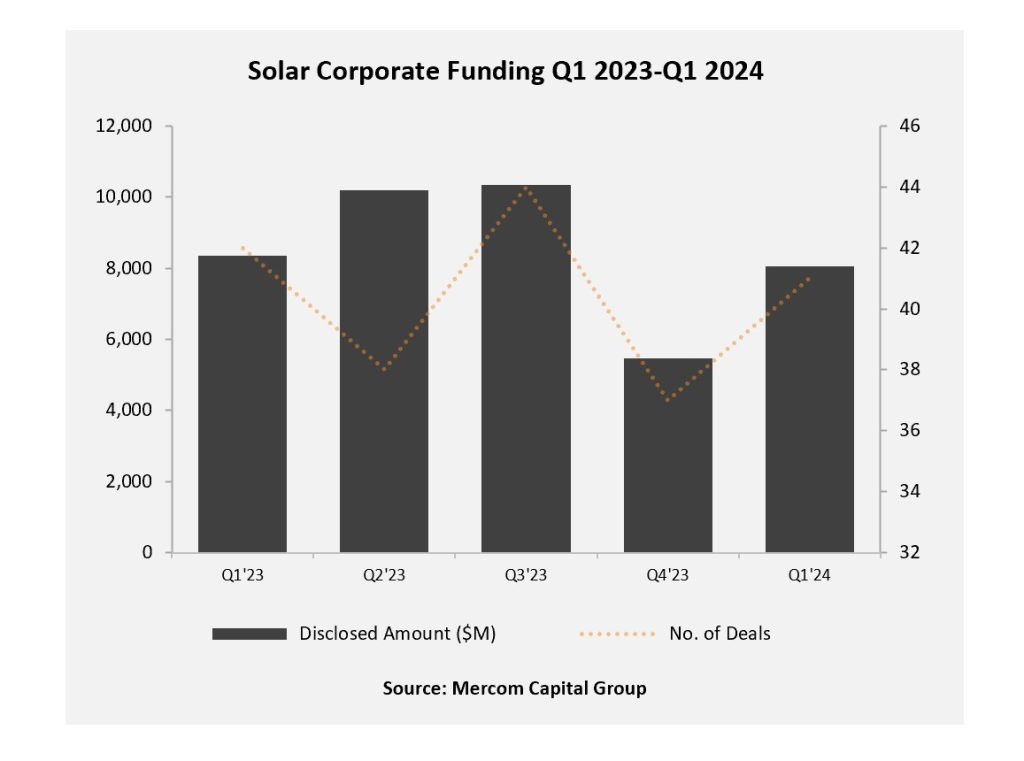

Total corporate funding into the solar sector in Q1 2024 came to $8.1 billion in 41 deals, a 4% decline year-over-year (YoY) compared to the $8.4 billion raised in 42 deals in Q1 2023. Funding increased 47% quarter-over-quarter (QoQ) compared to the $5.5 billion raised in 37 deals in Q4 2023.

Global VC funding for the solar sector in Q1 2024 came to $406 million in 13 deals, an 81% decline YoY compared to $2.1 billion raised in 18 deals in Q1 2023. Funding declined 68% QoQ compared to the $1.3 billion raised in 19 deals in Q4 2023.

Announced debt financing for the solar sector in Q1 2024 totaled $6.2 billion in 22 deals, a 59% increase YoY compared to Q1 2023, when $3.9 billion was raised in 17 deals. QoQ debt financing increased 55%, with $4 billion raised in 15 deals in Q4 2023.

A total of 21 solar M&A transactions were recorded in Q1 2024, the same amount as in Q4 2023, but about 22% lower compared to 27 solar M&A deals in Q1 2023.

Almost 10.8 GW of solar projects were acquired in Q1 2024 compared to 11.9 GW in Q1 2023. In a QoQ comparison, 13.7 GW of solar projects were acquired in Q4 2023.

There were 274 companies and investors covered in this 97-page report, which contains 66 charts, graphs, and tables.

Mercom Capital Group’s Quarterly Solar Funding and M&A Reports are comprehensive high-quality reports delivering superior insight, market trends, and analysis. These reports help bring clarity to professionals in the current financial landscape of the solar industry.

Also available:

Custom Excel Sheets with all transactions for the quarter, and

Custom Research with data from the past 5 years!

Contact us to learn more and get pricing!

Quarterly market and deal activity displayed in easy-to-digest charts, graphs, and tables, alongside data-driven analysis.

The report covers all types of deals and financing activity, including:

- Venture capital funding deals, including top investors, QoQ and YoY trends, and a breakdown of charts and graphs by technology, sector, stage, and country;

- Large-scale project funding deals, including top investors, QoQ and YoY trends and breakdown charts and graphs by technology and country;

- Public market financing, including equity financing, private placements, and rights issues;

- Debt and other funding deals, as well as QoQ and YoY trends;

- Third-party residential/commercial project funds;

- Large-scale project acquisitions and active project acquirers;

- Large-scale project announcements in various levels of development throughout the world;

- Mergers and acquisitions (M&A), including QoQ and YoY trends, a breakdown of charts and graphs by technology and sector, as well as project M&A activity;

- New cleantech and solar funds;

- New large-scale project announcements;

- Large-scale project costs per MW.

This report also contains comprehensive lists of all announced Q1:

- VC funding, debt financing, public equity financing, and project funding deals;

- VC and project funding investors;

- M&A transactions;

- Project acquisitions by amounts and megawatts;

- M&A, and project M&A transactions;

- Large-scale project announcements.