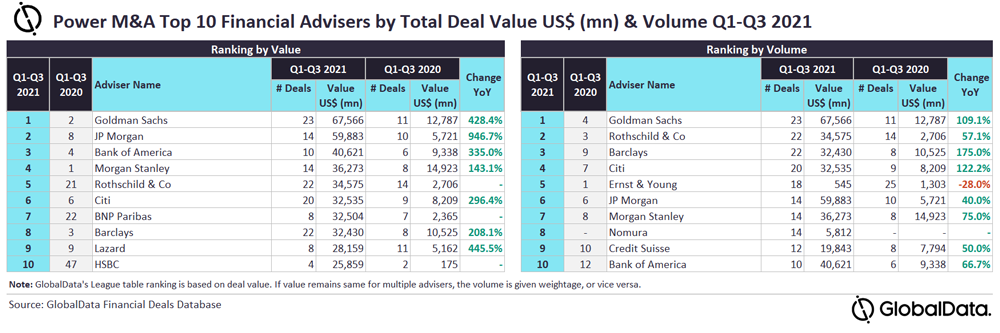

Goldman Sachs has emerged as the top financial adviser for mergers and acquisitions (M&A) by both value and volume in the power sector for Q1-Q3 2021, according to GlobalData, having advised on 23 deals worth $67.6bn. The leading data and analytics company notes that there was a total of 1,737 M&A deals announced in the power sector during Q1-Q3 2021.

According to GlobalData’s report, ‘Global and Power M&A Report Financial Adviser League Tables Q1-Q3 2021’, deal value for the power sector increased by 79.4% from $170bn during Q1-Q3 2020 to $305bn in during Q1-Q3 2021.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Goldman Sachs was the clear winner in terms of value, as it was the only adviser to surpass the $60bn mark on the back of its involvement in 11 deals valued more than or equal to $1bn. Its activity also included three mega deals, valued more than $10bn. Goldman Sachs also led by volume but faced tough competition from peers such as Rothschild & Co, Barclays and Citi.”

Rothschild & Co occupied the second position, in terms of deal volume, followed by Barclays, with 22 deals worth $32.4bn; Citi, with 20 deals worth $32.5bn, and Ernst & Young, with 18 deals worth $545m.

JP Morgan occupied the second position in terms of value, with 14 deals worth $59.9bn, followed by Bank of America, with ten deals worth $40.6bn, Morgan Stanley, with 14 deals worth $36.3bn, and Rothschild & Co, with 22 deals worth $34.6bn.