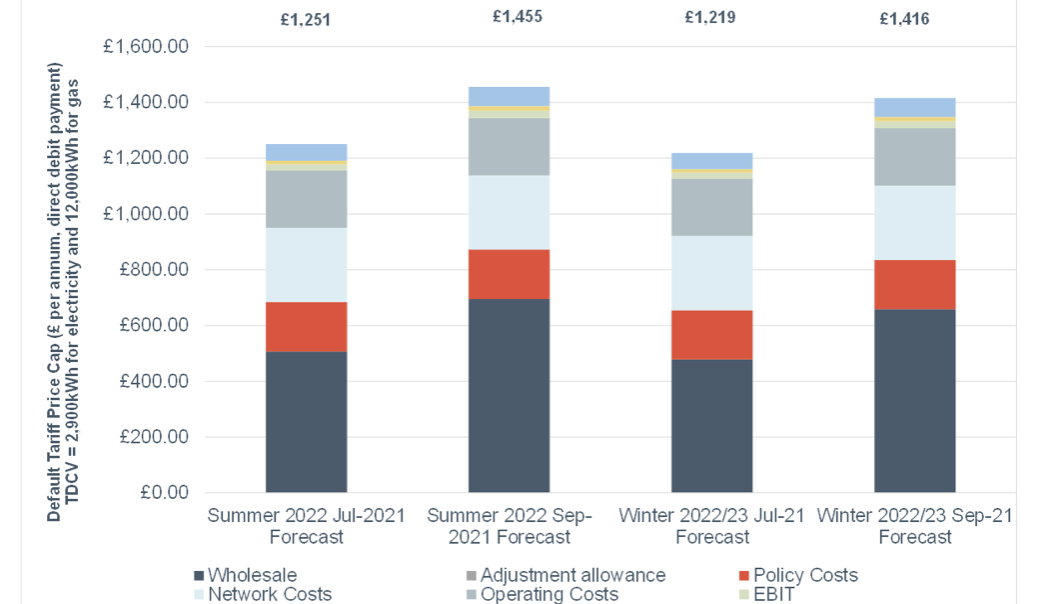

Despite the Winter 2021-22 default tariff price cap being a new record at £1,277, the latest forecast from Cornwall Insight modelling indicates that the Summer 2022 cap will see a further increase of approximately 14% increase against the Winter 2021-22 cap – taking the Summer 2022 cap to £1,455 per annum for a typical dual fuel customer.

Dr. Craig Lowrey, Senior Consultant at Cornwall Insight, said:

“These figures reflect material increases in the period since our most recent default tariff cap forecast at the end of July 2021. However, there is a lot of uncertainty regarding the wholesale market – and a long way to go before future default cap levels are confirmed in February 2022. The nature of the cap methodology means that some of the recent wholesale increases are already being priced into Ofgem’s formulae.

“The wholesale price methodology for the default tariff cap changes on a seasonal basis and effectively uses a 12-month rolling hedging strategy applied on a continuous quarterly (gas) or seasonal (electricity) basis.

“The cap uses a representative hedging profile for a typical domestic customer with weightings applied to quarterly and/or seasonal prices as required. Although a supplier could theoretically map the hedging requirements for its customers on a default tariff product to the Ofgem profile, there is no evidence of this practice being adopted.

“This means that in the case of the Winter 2021-22 cap, the observation window closed at the end of July 2021, with those energy suppliers that had not been able to hedge their positions in line with the cap methodology retaining an element of exposure to the wholesale market.

“It also means that we are already in the six-month window for the Summer 2022 cap, and with record wholesale prices now being priced in, we would need to see a material and sustained reduction in the wholesale market to avoid the kind of cap levels we are predicting for that period.

“In particular, smaller suppliers which – potentially due to costly collateral requirements and fees associated with trading – are not able to hedge in the medium to longer-term manner implied by the cap methodology have found themselves at a comparative disadvantage against their typically larger counterparts that are in a position to hedge in line with the cap.

“However, the conditions could potentially be reversed in a falling market, with those smaller suppliers using a more flexible, shorter-term hedging strategy being at a comparative advantage against those companies that had adopted a longer-term hedging strategy.

“The prospect of the greatest enforced consolidation in the retail supply market since that triggered by the collapse of TXU Energi in October 2002, due paradoxically to a record slump in wholesale prices and its effects on that company’s hedging strategy, risks compromising the overarching objectives of the default tariff cap – competition and customer choice – and turning back the clock to an oligopoly retail supply market.”

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.